On June 6, 2025, the Reserve Bank of India (RBI) surprised markets by announcing a 50 basis point (bps) cut in the repo rate, bringing it down to 5.50%. Along with this, the Cash Reserve Ratio (CRR) was slashed by 100 bps. While those sound like small percentages, they carry enormous weight in economic terms.

If you’re not someone who follows central bank policy closely, you might be wondering: What’s the repo rate? Why does 0.5% matter so much? And even more so: How does something that feels like a rounding error end up influencing your home loan, your job prospects, or even the price of vegetables?

Let’s break it down.

🏦 What Is the Repo Rate and Why It Was Cut

The repo rate is the interest rate at which the RBI lends money to commercial banks. Think of it as the foundation stone of interest rates in the economy. When the RBI cuts the repo rate, banks can borrow more cheaply, and in turn, they usually pass on the benefit to consumers in the form of lower loan rates. This boosts borrowing, spending, and investment—especially useful when the economy is slowing down and inflation is under control.

A 50 bps cut (0.5%) might not seem dramatic on paper, but in the world of monetary policy, it’s a significant move—more than what most analysts expected. Many anticipated a pause or a smaller cut. So this policy decision wasn’t just a rate cut, it was a message: the RBI is serious about stimulating growth, fast.

Want to read about how RBI started this growth run? Read this article here: How RBI hits the refresh button?

🧠 Sounds Small? Here’s Why It’s Not

Let’s put that 0.5% into context.

“0.5% doesn’t sound like much, does it? It’s half of one. Like, if something costs ₹100, you save 50 paise—not a big deal.

But now imagine this: You’ve taken a home loan. You’re paying ₹35,000 every month in EMIs. The RBI cuts the repo rate by 0.5%. The bank responds—and your EMI drops by around ₹1,800.

That’s your WiFi bill. Or your grocery bill for a week. Or your kid’s school shoes.

And this isn’t just you. Millions of people paying off homes, cars, or business loans see the same drop. So suddenly, there’s more money floating around in wallets, shops, and small factories.

That’s how a ‘tiny’ 0.5% moves the whole economy. It sounds like a whisper, but it echoes loudly.”

🧮 Anticipated vs Unanticipated Policy: Why the Surprise Matters

Here’s where economics gets a little more theoretical—but stay with me, it’s fascinating.

Economists have long debated how expectations shape the effect of policy. Two major schools help us understand this:

1. Rational Expectations Theory

- Assumes that people and markets are smart—they anticipate central bank actions based on all available information.

- If everyone expects a repo rate cut, they act in advance—banks adjust rates, markets price it in, businesses make decisions ahead of time.

- So when the policy is finally announced, its impact is already baked in.

- Only unanticipated changes—like a bigger-than-expected 50 bps cut—actually move the needle in the short run.

2. Neo-Keynesian View

- Agrees with rational expectations, but adds a layer: the real world has frictions.

- Prices and wages don’t adjust instantly. Contracts are sticky. People don’t always act perfectly rationally.

- So even if a policy move is anticipated, it can still have real effects—especially in the short term.

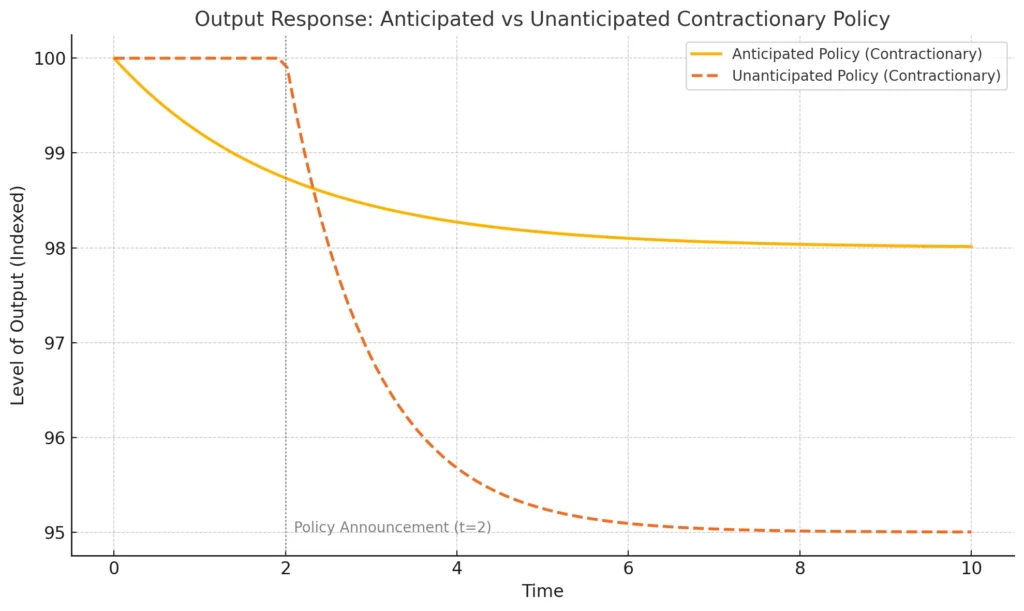

3. Contractionary Policy: A Repo Rate Hike

Source: Created by the author. Description: Contractionary Policy Graph.

A contractionary monetary policy (like an interest rate hike) seeks to slow down economic activity by increasing the cost of borrowing.

In the case of an anticipated rate hike, you can see in the graph above that the economy responds gradually. Businesses and consumers begin adjusting their plans well before the rate hike takes place. They reduce borrowing, spending, and investment. This results in a steady decline in output over time as people adjust to the fact that loans are becoming more expensive.

If the rate hike comes unexpectedly, the response is much more abrupt. The economy plunges quickly as businesses and individuals are caught off guard by the sudden change in borrowing costs. The output dips sharply in the immediate aftermath of the policy announcement, reflecting how unanticipated monetary actions cause a more severe and immediate reaction.

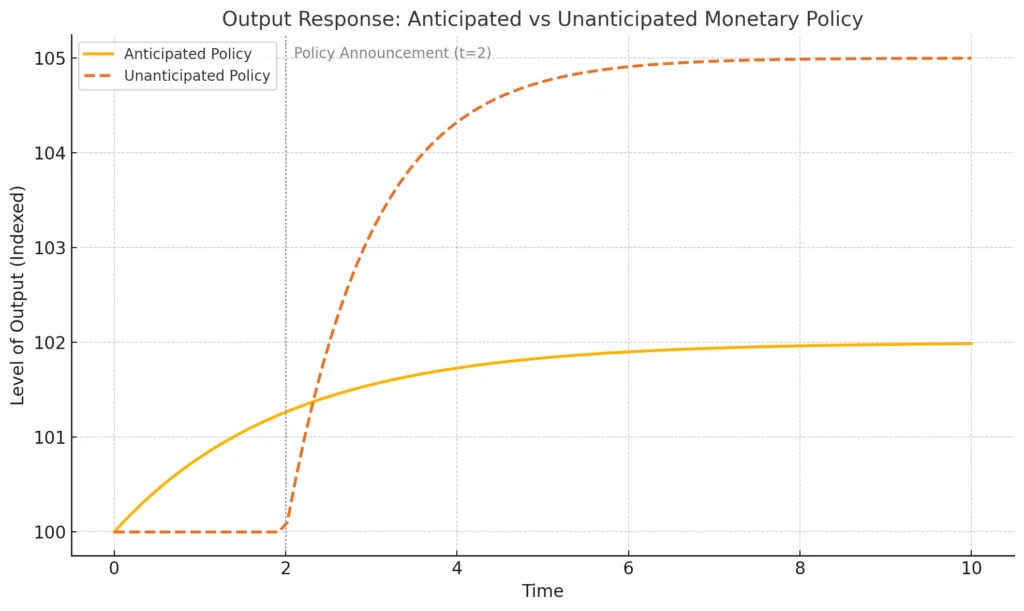

4. Expansionary Policy: A Repo Rate Cut

Source: Created by the author. Description: Expansionary Policy Graph.

In an expansionary monetary policy, such as the 50 bps repo rate cut by the RBI, the goal is to stimulate economic growth by lowering the cost of borrowing.

When the policy is anticipated, markets and businesses start adjusting even before the RBI announces the rate cut. You can see in the above graph that the economy starts responding gradually, with output steadily rising as both consumers and producers prepare for the cheaper borrowing environment. This smoother response reflects the fact that people and businesses expected the change, so they act in advance to take advantage of lower interest rates.

However, when the policy is unanticipated, the effect is more abrupt. In the second graph (showing an unanticipated rate cut), we see a sharp increase in output immediately after the rate cut is announced. This is because markets weren’t expecting it, so the sudden change shocks the system, resulting in a quicker and stronger response. Consumers rush to take loans, businesses ramp up investment, and markets react sharply, all contributing to a faster recovery.

This shows how small changes in the repo rate can have a disproportionate impact when they come as a surprise.

This stark contrast between anticipated and unanticipated rate hikes further illustrates the significant role that expectations play in shaping economic behavior. In both expansionary and contractionary policies, the market’s reaction depends heavily on whether the policy is anticipated or not. The gradual changes in the anticipated cases highlight the economy’s ability to adjust ahead of time, while sharp movements in the unanticipated cases underscore how unexpected policies can shake up businesses and consumers, triggering swift and sometimes intense reactions.

🎯 So What Happened With the RBI?

The 50 bps cut wasn’t fully expected—markets were leaning toward a smaller move or no move at all. That means this cut falls into the category of a partially unanticipated policy. As per both theoretical lenses:

- Rational expectations says this surprise can jolt behavior, because it changes what people thought was going to happen.

- Neo-Keynesian thinking says even if you expected it, the cut still works, especially when the economy isn’t operating at full capacity.

That explains why we saw stock markets rise, especially in rate-sensitive sectors like banking, real estate, and automobiles. Investors responded to the shock, banks prepared to cut loan rates, and businesses began recalibrating.

🧾 Final Thought

Monetary policy often sounds sterile—repo rates, basis points, liquidity injections. But beneath the jargon, it’s about real choices and real lives. A policy that changes by 0.5% can tilt the direction of an economy, shift business plans, lower the cost of dreams, or even save a family from defaulting on a loan.

Understanding how expectations shape the power of policy is key—not just for economists, but for every citizen whose life is quietly touched by the RBI’s decisions.

So next time someone says, “It’s just a 0.5% cut,” you’ll know: it’s never just a number.