Global GDP growth has weathered intense turbulence over the past two decades, with each major disruption — from the Global Financial Crisis (GFC) of 2008–09 to the COVID-19 pandemic — leaving deep and lasting imprints on the world economy. History shows that recovery periods are fragile, and that missteps — whether through premature tightening or rising protectionism — can quickly derail hard-won gains.

Today, as stricter tariffs and the threat of renewed trade wars resurface, the International Monetary Fund (IMF) is sending a clear and timely message: the path to sustainable global growth requires restraint, cooperation, and coordinated policy action. Drawing from both Keynesian stabilization theories and Neoclassical growth models, the IMF stresses that a careful blend of fiscal support, accommodative monetary policy, and long-term structural reforms is essential — and that the mistakes of the past must not be repeated.

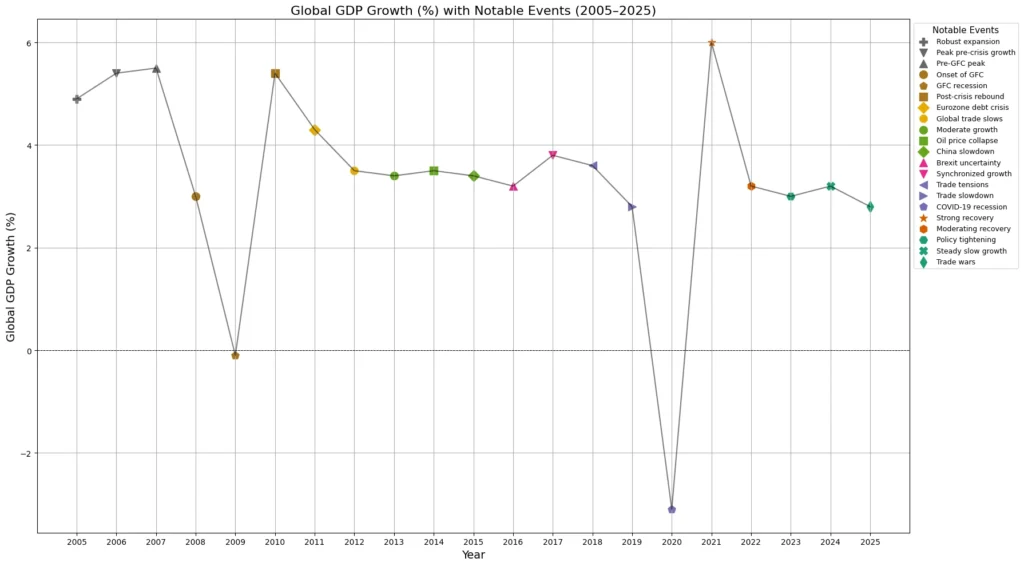

A Historical Perspective on Growth Volatility (2005–2025)

Data Source: IMF Database, created by the author.

From 2005 to 2007, the global economy experienced robust expansion, culminating in peak pre-crisis growth. However, the 2008–09 GFC triggered a sharp contraction, pulling GDP growth into near-zero territory.

Following an aggressive policy response, the world witnessed a rapid recovery by 2010, only to slow down again due to the Eurozone debt crisis and subsequent trade tensions between major economies.

The COVID-19 pandemic in 2020 created an even sharper decline (~–3%), the most severe contraction in decades. However, the global economy rebounded quickly in 2021 due to coordinated fiscal and monetary interventions.

Heading into 2022–2025, the IMF projects moderate but uneven growth, constrained by tightening financial conditions, the challenge of managing inflation, and the urgent need to rebuild fiscal buffers. Yet these projections also come against a backdrop of rising protectionist pressures, with stricter tariffs and potential trade wars threatening to fragment global commerce just as the world economy struggles to recover from the COVID-19 shock.

The pattern from history is unmistakable:

- Crises cause deep contractions.

- Policy interventions drive recoveries.

- Lack of structural reforms — and premature tightening or isolationist policies — cause growth momentum to fade.

Thus, the IMF’s latest projections are not merely forecasts — they are pointed policy signals. Without continued support, openness, and reform, there is a real risk that the fragile global recovery could stall, repeating the costly mistakes made after previous crises.

The Technical Policy Response: A Three-Pillar Strategy

The IMF is implicitly recommending a balanced macroeconomic strategy, drawing heavily from modern economic theory.

1. Fiscal Policy: Boosting Aggregate Demand

The basic idea here is that the government should step in and spend more money during economic downturns to boost overall demand and create jobs. This is called expansionary fiscal policy. Specifically, spending more on things like roads, renewable energy, and digital technology can stimulate growth where private businesses might hesitate. A key economic principle here, called the Keynesian multiplier, says that every dollar the government spends can generate more than a dollar in total economic output because the money gets re-spent multiple times.

Lowering certain types of taxes, especially those that discourage working and investing, can also help people and businesses spend more. A concept called the Laffer Curve suggests that if tax cuts are well-designed, they can even boost economic activity enough to prevent major losses in government revenue. Additionally, reinforcing programs like unemployment insurance automatically supports families during bad times without needing new legislation each time.

Borrowing money to fund these efforts is sustainable if the interest the government pays on its debt is lower than the economy’s growth rate. Economist Olivier Blanchard famously pointed this out in 2019. Importantly, the International Monetary Fund (IMF) warns that cutting back government spending too early (like after the 2008 financial crisis) can crush fragile recoveries.

Key message: Expansionary, yet targeted fiscal policy is essential.

- Government Spending (G↑): Increased investment in infrastructure, green energy, and digital sectors is critical.

- Keynesian Multiplier: ΔY = (1/1–MPC) × ΔG → Higher G raises Y significantly when private sector demand is weak.

- Tax Policy (T↓): Lower distortionary taxes to incentivize consumption and investment.

- Laffer Curve Insight: Properly designed tax cuts can stimulate supply-side responses without large revenue losses.

- Automatic Stabilizers: Reinforcing unemployment insurance and welfare programs stabilizes consumption during downturns.

- Public Sector Borrowing: Strategic borrowing is sustainable when real interest rates are lower than growth rates (r < g), as argued by Blanchard (2019).

IMF’s Implicit Warning: Premature fiscal tightening can choke recovery, as seen post-GFC.

2. Monetary Policy: Supporting Recovery Without Fueling Instability

Here, the focus is on what central banks (like the Federal Reserve) should do. They should keep interest rates very low or only raise them slowly to encourage businesses to invest and households to spend. This helps kick-start the economy when it’s weak.

Sometimes, even cutting interest rates isn’t enough. In that case, the central bank can use Quantitative Easing (QE), which means buying financial assets to inject money into the economy and push down long-term borrowing costs. Another tool, Yield Curve Control (YCC), involves directly setting targets for various interest rates across the economy, making it even easier for businesses to borrow and invest.

Clear communication, known as forward guidance, is also crucial: by telling everyone what to expect from future policies, central banks can influence behavior today. The dual mission of central banks should be to both control inflation and ensure people have jobs — not just focus on one or the other.

The IMF also warns against raising interest rates too fast, because that could hurt the recovery just when it’s starting to take off.

Key message: Monetary policy must be flexible, forward-looking, and supportive.

- Policy Rates (i↓ or hold low): Keeping interest rates low encourages investment (I↑) and consumption.

- Quantitative Easing (QE): Asset purchases lower long-term rates, vital when economies face liquidity traps (Krugman, 1998).

- Yield Curve Control (YCC): Targeting broader yield curves anchors expectations and supports private investment.

- Forward Guidance: Clear communication about future policy helps manage inflation and employment expectations (Expectations-Augmented Phillips Curve).

- Dual Mandate: Inflation and employment must both be priorities, in line with New Keynesian Dynamic Stochastic General Equilibrium (DSGE) models.

IMF’s Emphasis: Overaggressive monetary tightening could derail fragile output recoveries.

3. Structural Policies: Laying the Foundation for Long-Run Growth

This part explains that while boosting demand is important, it’s not enough. To keep the economy strong over the long haul, we need to improve its “supply side” — how much the economy can actually produce.

First, we need to heavily invest in education and training, because a more skilled workforce means higher productivity, as economist Robert Lucas emphasized. We also need to invest in research and innovation so new technologies and industries can emerge — a point made by Paul Romer’s growth model.

Modernizing labor laws is another must. Making it easier for workers to find new jobs or move between companies will help reduce unemployment. Building green infrastructure (like renewable energy grids) also boosts private sector productivity and helps fight climate change.

If these deeper issues aren’t fixed, the short-term benefits from higher spending and low interest rates will eventually fade out, as the IMF notes.

Key message: Short-term stabilization is insufficient without long-term productivity enhancements.

- Human Capital Investment (H↑): Large-scale reskilling and education investment, supporting Lucas (1988)’s theory that human capital drives sustained growth.

- Research & Development (R&D): Funding innovation sectors, building on Romer (1990)’s Endogenous Technology Growth Model.

- Labor Market Flexibility: Modernizing labor laws to reduce frictions in hiring and mobility (Diamond-Mortensen-Pissarides Matching Theory).

- Infrastructure Development: Green infrastructure projects create positive externalities, boosting private sector productivity.

IMF’s Long-Term Vision: Without addressing supply-side bottlenecks, aggregate demand boosts will have diminishing returns.

Mathematical Summary: How Policies Impact GDP

In the short run, policies like increased government spending (G↑), lower taxes (T↓), and lower interest rates (i↓) shift the overall demand upward, making the economy produce more (Y↑).

In the short-run:

Using the Aggregate Demand–Aggregate Supply (AD-AS) model:

$ Y=C(Y−T)+I(i)+G+NX $

- Fiscal Policy: Increase G, reduce T → AD shifts right → Output (Y) increases.

- Monetary Policy: Decrease i → Stimulates I → AD shifts right.

But in the long run, real sustainable growth depends on improving technology (A), building more capital (K) like machines and factories, and expanding the labor force (L). Structural reforms are what help raise these critical components so that the economy’s potential keeps growing over time.

In the long-run:

Potential output $Y^*$ rises through:

$Y^*=A⋅f(K,L)$

Where:

- A = Technological progress

- K = Capital accumulation

- L = Labor force expansion

Thus, structural reforms are key to sustaining $Y^*$ growth.

Final Word: What the IMF Wants to Convey

The IMF’s projections, historical analysis, and policy frameworks suggest that the recovery of global GDP is fragile, uneven, and heavily policy-dependent.

Without a combined fiscal, monetary, and structural reform package, guided by modern macroeconomic theory, the world risks falling into a cycle of slow growth, high debt, and rising inequality.

In simple terms:

- Stimulate demand now → Secure growth today.

- Reform supply-side structures → Ensure growth tomorrow.

The future of global GDP growth, therefore, depends on comprehensive, intelligent, and coordinated economic management.

[…] Global Commodity Markets – Energy and Grains Deliver Predictability, But Watch the Wildcards The IMF Might Be Suggesting: Premature Tightening Could Derail Global Growth What Is the Opportunity Cost of Unity? India–U.S. Trade Talks: Cooperation or […]

[…] Finding it interesting? Read another one: IMF Suggestions […]