India’s digital economy is undergoing a rapid transformation, fueled by a surge in digital payments and the ambitious implementation of the Central Bank Digital Currency (CBDC). As the Reserve Bank of India (RBI) spearheads efforts to modernize the financial ecosystem, India’s digital payments landscape and CBDC adoption present a fascinating case study in financial innovation.

The Rise of Digital Payments in India

India’s digital payment revolution continues to gain momentum, primarily driven by the Unified Payments Interface (UPI). In the first half of 2024 alone, UPI transactions surged by 52% year-on-year, reaching an impressive 78.97 billion transactions. This exponential growth underscores India’s growing preference for cashless transactions and the deep penetration of digital payment systems across urban and rural areas alike.

As of January 2025, PhonePe dominated the UPI market with a commanding 48.4% share, followed by Google Pay at 37%. This near-duopoly in the digital payments space highlights the intense competition among fintech players striving for market leadership. The increasing reliance on mobile-based transactions further cements India’s position as a global leader in digital finance.

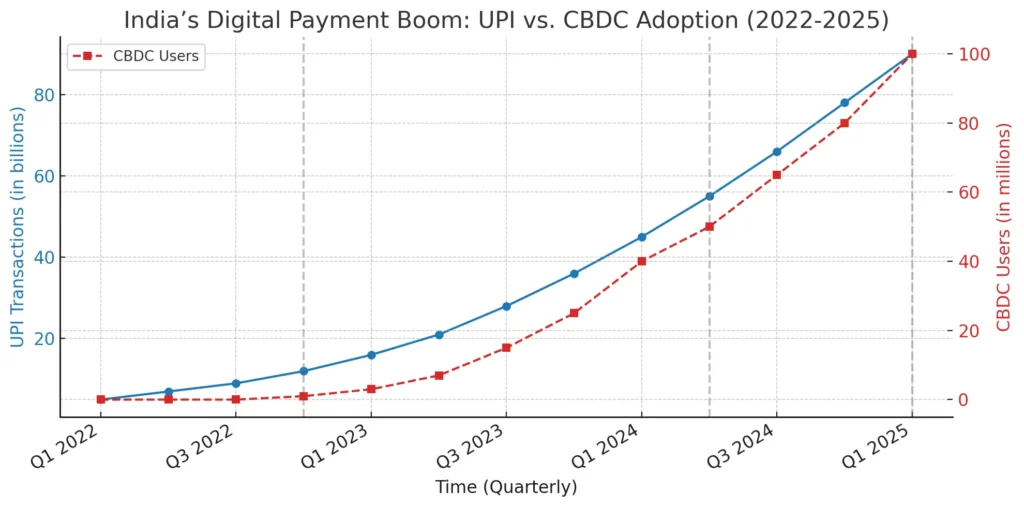

Figure: India’s Digital Payment Boom – UPI vs. CBDC Adoption (2022-2025).

Source: Created by the author.

The graph illustrates the rapid expansion of India’s UPI transactions alongside the adoption of the CBDC from 2022 to early 2025. UPI transactions have experienced exponential growth, surpassing 78.97 billion in the first half of 2024, driven by the increasing digitalization of payments. Meanwhile, India’s retail CBDC pilot, which launched in December 2022, has steadily gained traction, reaching 5 million users by mid-2024 and accelerating further with fintech participation in early 2025. The key milestones marked in the graph—CBDC pilot launch, 5M user milestone, and Cred’s integration—highlight the evolving landscape of digital payments in India.

CBDC Adoption: India’s Digital Rupee Journey

To complement the digital payments revolution, the RBI has been actively developing its Central Bank Digital Currency (CBDC). Since its launch in December 2022, the retail CBDC pilot has made significant strides, expanding to 5 million users and 420,000 merchants by June 2024. This expansion signifies growing acceptance and integration of the digital rupee within India’s financial ecosystem.

A key milestone in this journey came in January 2025, when fintech firm Cred became the first non-bank platform to facilitate e-rupee transactions. This move is expected to accelerate CBDC adoption by enhancing accessibility and creating seamless user experiences for digital currency transactions.

How India Stacks Up: A Global Perspective

While India’s progress in digital currency implementation is commendable, a comparison with China’s digital yuan reveals the scale of challenges ahead. By June 2024, China’s digital yuan had already reached a staggering transaction volume of 7 trillion yuan (approximately $986 billion), demonstrating a far more extensive CBDC rollout.

India’s approach, however, is unique—focusing on gradual adoption, interoperability with existing digital payment systems, and leveraging private fintech partnerships to boost acceptance. As the ecosystem matures, India is poised to bridge the gap and establish itself as a global leader in digital currency adoption.

The Road Ahead

India’s digital economy stands at the cusp of a transformative era. The rapid growth of digital payments, coupled with CBDC adoption, signals a paradigm shift in the way financial transactions are conducted. However, challenges such as regulatory clarity, cybersecurity concerns, and infrastructure readiness must be addressed to ensure seamless integration and widespread adoption.

As the RBI and fintech players continue to innovate, India’s digital financial future looks promising. Whether it’s UPI redefining global payment trends or CBDC setting new benchmarks in digital currency adoption, India is undoubtedly shaping the future of digital finance.