The National Housing Bank (NHB) recently released its annual report on India’s housing sector, offering a detailed analysis of trends in home loans, property prices, regional disparities, and government initiatives. The report provides crucial insights into how the housing market is evolving, which in turn affects homebuyers, investors, policymakers, and the broader economy.

Rising Demand for Home Loans

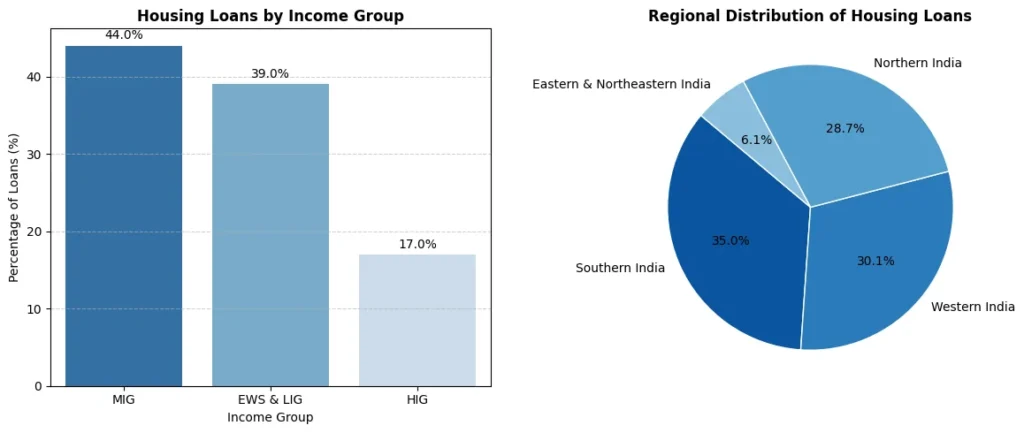

As of September 2024, the total outstanding home loans in India reached ₹33.53 lakh crore, marking a 14% increase from the previous year. This steady rise indicates a growing aspiration for homeownership across the country, supported by favorable lending conditions and increased disposable income. Home loan borrowers are primarily from the Middle-Income Group (MIG), which accounts for 44% of the total. The Economically Weaker Sections (EWS) and Low-Income Group (LIG) together make up 39%, while High-Income Groups (HIG) contribute 17%. This distribution shows that housing finance is becoming more inclusive, although affordability remains a challenge in many urban centers.

Data Source: NHB Report (2024).

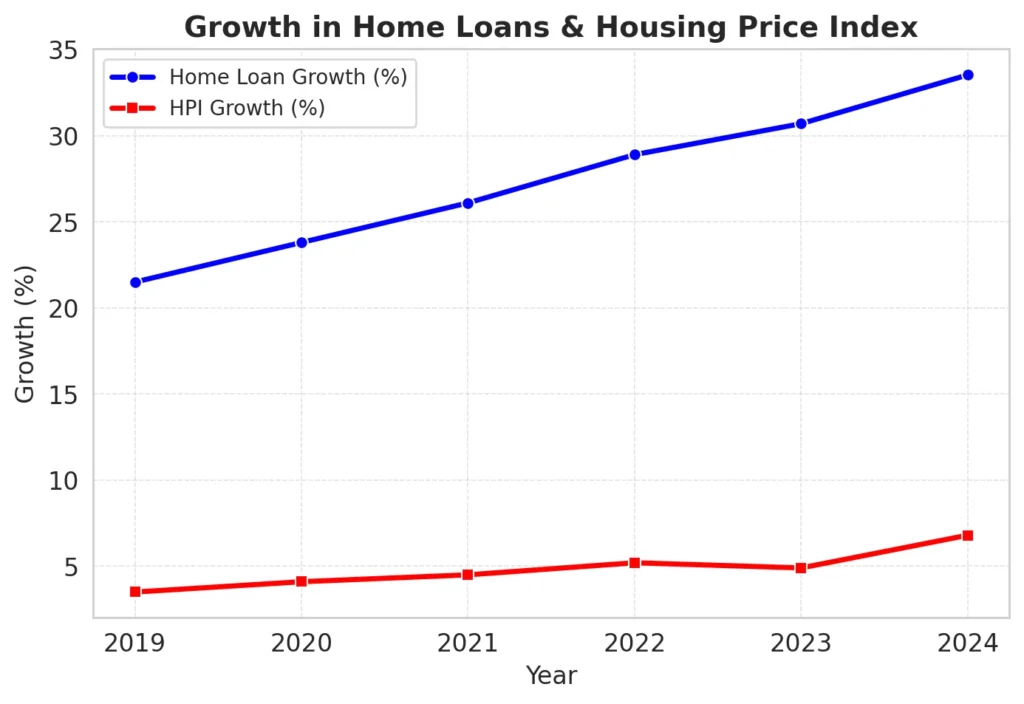

The combined line plot illustrates the parallel rise in home loan disbursements and the Housing Price Index (HPI) over recent years. The steady increase in home loans reflects the growing demand for housing, driven by favorable lending conditions, higher disposable incomes, and government incentives. Meanwhile, the upward trend in HPI signals sustained price growth due to urban migration, increasing construction costs, and limited housing supply. The graph highlights how housing demand fuels price appreciation, creating both opportunities and affordability challenges for buyers.

Accelerated Loan Disbursements

Between April and September 2024, home loan disbursements amounted to ₹4.10 lakh crore, and for the entire financial year (April 2023 to March 2024), total disbursements reached ₹9.07 lakh crore. The increasing loan disbursement highlights a strong housing demand, driven by lower interest rates, increased employment opportunities, and government incentives for homebuyers.

Housing Prices Continue to Rise

Housing prices have been on an upward trajectory, reflecting strong demand and constrained supply. The NHB’s Housing Price Index (NHB-RESIDEX) recorded a 6.8% increase in property prices in September 2024 compared to a 4.9% growth in the previous year. This price surge is particularly noticeable in metro cities and fast-growing urban hubs, where demand continues to outstrip supply. The key drivers behind this price rise include high land acquisition costs in urban areas, increased construction costs due to rising material prices and labor expenses, growing demand for premium and luxury housing, and urban migration, which has led to a surge in housing demand in major cities.

Government Initiatives to Boost Affordable Housing

The Indian government has implemented several housing schemes aimed at making homeownership more accessible, particularly for lower and middle-income groups. These include Pradhan Mantri Awas Yojana (PMAY), which focuses on providing affordable housing for both urban and rural populations by offering interest subsidies and incentives; the Urban Infrastructure Development Fund (UIDF), which aims to strengthen urban infrastructure, improving the quality of life and making cities more livable; and the Affordable Rental Housing Complexes (ARHC) Scheme, which seeks to provide affordable rental housing, particularly for migrant workers and economically weaker sections. These initiatives are crucial in addressing India’s housing shortage, although challenges remain in execution and accessibility, particularly in underdeveloped regions.

Regional Disparities in Housing Finance

Housing finance growth has been uneven across India, with some regions experiencing rapid expansion while others lag behind. The NHB report highlights the regional distribution of home loan disbursements: Southern India accounts for 35.02%, Western India 30.14%, Northern India 28.73%, and Eastern and Northeastern India 6.10% (with the Northeast at just 0.68%). This data shows that major urban centers in the south, west, and north are leading the housing boom, whereas the eastern and northeastern states remain underserved. Addressing these regional disparities requires enhanced financial inclusion and better infrastructure development in less-developed areas.

Data Source: NHB Report (2024).

The bar chart illustrates that the majority of housing loans are distributed among the Middle-Income Group, followed closely by the EWS & LIG segments, with the High-Income Group receiving a smaller portion. This distribution underscores the focus on making housing finance accessible to lower and middle-income populations.

The pie chart highlights the regional disparities in housing loan disbursements, with Southern, Western, and Northern India accounting for the majority of loans, while Eastern and Northeastern regions receive a significantly smaller share. This visualization emphasizes the need for targeted financial inclusion strategies in underrepresented areas.

Challenges Facing the Housing Sector

Despite positive growth trends, the housing sector faces several challenges that could impact its long-term stability. Climate change and natural disasters pose a significant threat, as many Indian cities are prone to flooding, cyclones, and other extreme weather events, which affect housing stability and increase insurance costs. The high cost of green buildings remains a concern, as sustainable housing is gaining importance, but eco-friendly construction is still expensive. Limited availability of green building certifications further restricts the sector’s transition toward sustainability. Urban congestion and infrastructure deficiencies are another major challenge, as rapid urbanization has led to overcrowded cities, inadequate transport facilities, and a strain on essential services such as water and electricity. Additionally, delays in project completion continue to be an issue due to regulatory hurdles, land acquisition problems, and financing constraints, leading to project backlogs and increased costs for buyers.

Technology and Innovation in Housing

Technology is playing an increasingly important role in transforming India’s housing sector. The NHB report highlights several emerging trends that are set to reshape the industry. Digital land records are being pushed to improve transparency, reduce fraud, and simplify property transactions. Smart construction techniques, including the use of prefabricated materials, 3D printing, and AI-driven planning, are helping speed up construction while maintaining quality standards. AI-powered home financing is also gaining traction, with artificial intelligence and big data analytics enabling better risk assessment, customized loan offerings, and faster loan approvals for homebuyers.

Expert Opinions on Market Growth

Industry leaders remain optimistic about India’s housing market, citing increasing homeownership aspirations and urban expansion as major drivers. Ashok Kapur, Chairman of Krisumi Corporation, notes that India’s growing middle class is fueling housing demand, with a preference for well-planned, modern living spaces. Pradeep Aggarwal, Chairman of Signature Global, highlights the need for continued government support to make housing more affordable and accessible to a broader segment of the population. Anuj Puri, Chairman of ANAROCK Property Consultants, emphasizes that infrastructure improvements, policy reforms, and technological advancements will be key to sustaining growth in the housing sector.

Conclusion

The NHB’s 2024 report paints an optimistic picture of India’s housing market, characterized by rising home loan disbursements, increasing property prices, and strong government support for affordable housing. However, challenges such as regional disparities, climate risks, and urban congestion need to be tackled for long-term sustainability. With the adoption of technology and continued policy support, India’s housing sector is well-positioned for steady growth in the coming years.