The trade relationship between India and the United States has entered a pivotal chapter in 2025, as the two largest democracies actively pursue a strategic economic partnership. Triggered by former President Donald Trump’s reimplementation of reciprocal tariffs, the trade dialogue has intensified, bringing renewed focus on tariff realignments, market access, and shared geopolitical interests.

Background: The Return of Reciprocal Tariffs

In April 2025, President Trump announced a sweeping reciprocal tariff regime that targets countries imposing higher duties on U.S. goods. This move echoes his 2018 policy stance and aims to correct perceived trade imbalances by leveling the playing field. Although India has not yet been directly affected, the announcement accelerated its trade negotiation efforts with Washington, focusing on long-term benefits over short-term friction.

Current Status of Discussions

The bilateral trade relationship is now framed around the ambitious Bilateral Trade Agreement (BTA), with both nations aiming to double their trade volume to $500 billion by 2030.

- Negotiation Progress: Both nations have signed the terms of reference for the initial phase of the BTA. The first in-person discussions are scheduled for mid-May.

- Tariff Reductions: India is considering significant tariff reductions on over half of $23 billion worth of U.S. imports, marking its largest tariff cut in years.

- Energy Imports: India is contemplating eliminating import taxes on U.S. ethane and liquefied petroleum gas (LPG) to deepen bilateral trade ties and reduce its trade surplus.

Key Sectors: Who Gains, Who Adjusts?

1. Agriculture: Big Win for the U.S.

- India is set to lower tariffs on almonds, apples, walnuts, and pulses, opening the floodgates for American farmers.

- Estimated Reduction: 20–40%

- U.S. Exports will increase significantly; India protects consumer interests by diversifying food sources.

- India’s Farm Sector sees minimal direct benefit, though price pressures could create domestic backlash.

2. Pharmaceuticals & Medical Devices: A Two-Way Street

- India may win regulatory relief on FDA approvals and tariff cuts on generic drugs exported to the U.S.

- U.S. firms (e.g., Medtronic, Abbott) may gain access to India’s vast market through relaxed price caps and customs duties.

- Estimated Reduction: Up to 50% on specific high-tech devices.

3. Energy Sector: A Geostrategic Pivot

- India is considering eliminating import taxes on U.S. ethane and LPG—a move aligned with decarbonization goals.

- Tariff Reductions: 5–10%

- U.S. LNG and crude exports are poised to surge, reducing India’s dependence on Middle Eastern suppliers.

- Strategic Angle: This helps secure U.S. energy market influence in South Asia.

4. Technology & Digital Trade: Data vs Dollars

- The U.S. is pushing India to relax data localization rules and allow cloud service expansion.

- India’s Dilemma: Maintain digital sovereignty or incentivize innovation and investment.

- Tariff reductions on hardware like semiconductors are expected (10–25%).

5. Textiles, Leather & Apparel: India’s Bargaining Chip

- India seeks restoration of GSP for labor-intensive sectors—handicrafts, textiles, leather.

- If granted, Indian exports to the U.S. may grow by $1–2 billion annually.

- Estimated Relief: 10–15% tariff rollback possible.

6. Automobiles & Auto Components: Slow Movement

- India’s 100% import duty on fully built cars is a long-standing U.S. grievance.

- Minor concessions may include phased reductions (5–10%) and relaxed homologation norms.

- Indian exports (auto parts) may face pressure if reciprocal duties are enforced by the U.S.

Trade Balance, Power Dynamics, and Speculative Impact

The table offers a snapshot of expected trade shifts between the U.S. and India across key sectors, shaped by ongoing tariff changes and strategic negotiations. It highlights which industries are likely to gain, remain stable, or face challenges in the evolving trade landscape, providing a clear view of sector-wise impacts on exports from both nations.

| Sector | U.S. Exports (Effect) | India’s Exports (Effect) |

|---|---|---|

| Agriculture | Strong Increase | Flat |

| Energy | Strong Increase | N/A |

| Pharma/Devices | Moderate Increase | Moderate Increase |

| Tech & Electronics | Moderate Increase | Mixed |

| Textiles & Leather | Flat | Moderate Increase |

| Automobiles | Slight Increase | Slight Decline |

As it can be observed, U.S. exports are set to benefit significantly—particularly in agriculture, energy, and pharmaceuticals—driven by India’s planned tariff cuts and diversification goals. Meanwhile, India’s gains appear more selective, with modest improvements expected in textiles, pharmaceuticals, and IT services. However, challenges remain in autos and agriculture due to persistent regulatory and market access barriers. Overall, while India’s concessions signal a long-term play for investment and geopolitical leverage, the U.S. stands to make broader near-term trade gains.

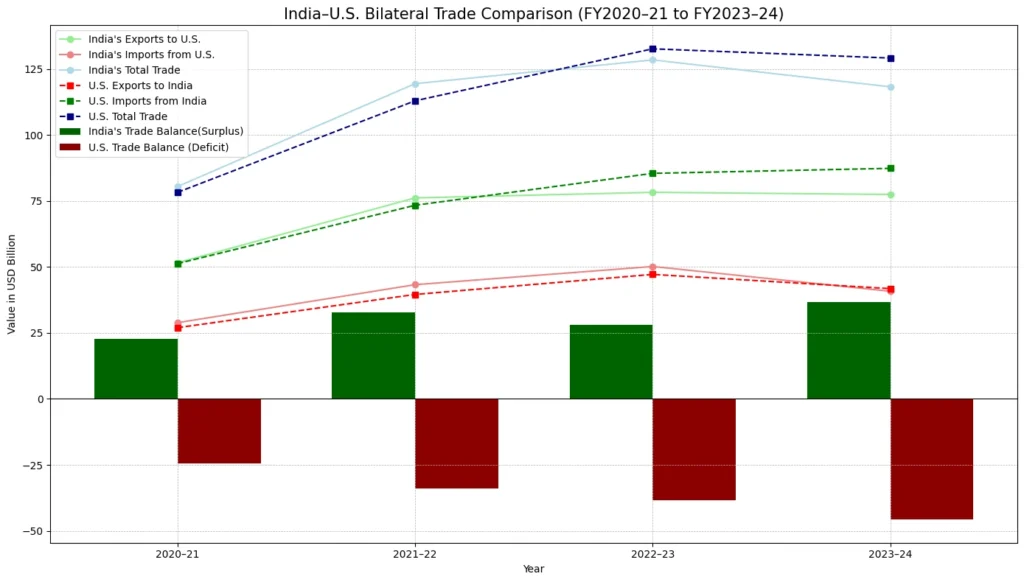

Visualizing the Trade Gap: Why Balance Matters

Data Source: YCharts; ImportData.

Figure: India–U.S. Trade Balance (FY2020–21 to FY2023–24)

A growing surplus for India underscores the U.S.’s push for tariff realignment and balanced trade under the proposed BTA.

The chart illustrates the trajectory of India–U.S. bilateral trade from FY2020–21 to FY2023–24, emphasizing a persistent and growing trade surplus for India. India’s exports to the U.S. consistently outpace imports, leading to an expanding surplus (green bars) and a corresponding deepening of the U.S. trade deficit (red bars). Total trade volume between both nations has increased steadily, aligning with the efforts to double bilateral trade to $500 billion by 2030. U.S. exports to India have grown modestly, particularly in pharmaceuticals and electronics, while Indian imports remain relatively restrained—highlighting India’s traditionally protective tariff structure. This historical imbalance validates the U.S.’s push for reciprocal tariffs and underpins the new BTA’s focus on energy, agriculture, and technology exports from the U.S., which are expected to show sharper growth post-2025.

The graph shows how India has been selling much more to the U.S. than it buys, leading to a trade gap that’s been growing year after year. While overall trade between the two countries is increasing, the U.S. feels it’s not exporting enough to India—something it’s now aiming to fix through the new trade agreement. As India agrees to lower taxes on some American goods like energy, farm products, and tech items, we’ll likely see more U.S. exports coming in soon. This chart gives a clear picture of why the U.S. wanted a more balanced trade deal and how things might start shifting from 2025 onward.

Strategic Speculation: Who Truly Benefits?

While the deal between India and the U.S. will likely be promoted as a win-win, early signs show that the U.S. might gain more — especially in areas like farming, energy, and tech. So, why is India still going ahead?

India has its own goals:

- Avoiding reciprocal tariffs (i.e. Avoid extra U.S. taxes on its exports)

- Securing GSP benefits (i.e. special trade benefits for small industries like textiles and handicrafts)

- Attracting U.S. investment in Make-in-India sectors (i.e. Attract more American companies to invest and build in India)

- Strengthening geopolitical ties amid China-U.S. competition (i.e. strengthen U.S. relations to balance out China’s increasing influence)

India’s calculated concessions may reflect a longer-term strategy to integrate deeper into U.S.-led supply chains and global trade governance.

Conclusion: The Bigger Picture

The India-U.S. trade realignment marks more than just tariff negotiations—it reflects a recalibration of global economic power and strategic intent. As both nations prepare for a decisive round of negotiations in May 2025, the world watches closely. A successful trade pact could serve as a template for high-trust, rules-based trade frameworks in the Indo-Pacific and beyond.

Only time will tell whether this “mutually beneficial” deal truly balances trade aspirations—or merely delays the next phase of tariff warfare.