The Reserve Bank of India (RBI) recently announced a big change that will allow more foreign money to flow into the Indian stock market. On March 27, 2025, the RBI stated that individual foreign investors can now own up to 10% of a listed company, instead of the previous 5%. The total foreign investment limit for all such investors combined will also increase from 10% to 24%. This move is expected to bring more money into the Indian economy, especially at a time when foreign investors have been pulling out.

Why Is This Change Happening?

In recent months, foreign investors have been withdrawing large amounts of money from Indian stocks—about 12 billion USD between October 2024 and February 2025.

Data Source: RBI Annual Report 2024-25.

The bar graph visually represents the fluctuations in foreign investment inflows and outflows over the past year. The sharp decline between October 2024 and February 2025 highlights the period when foreign investors pulled out 12 billion USD due to global market conditions and rising U.S. interest rates. The visualization makes it clear that investment flows have been volatile, reinforcing why the RBI’s decision to raise the cap on foreign ownership is a strategic move to attract long-term foreign capital.

Many factors contributed to this, including rising interest rates in the U.S. and global uncertainty. To counter this trend and make Indian markets more attractive, the RBI has decided to allow higher foreign investments.

At present, foreign investors hold nearly 55.6 lakh crore INR (670 billion USD) worth of Indian stocks, making up about 17% of the total market value. By increasing the investment cap, the RBI hopes to encourage foreign investors to put more money into key industries like technology, banking, and healthcare, which already receive the most foreign interest.

Data Source: RBI Annual Report 2024-25.

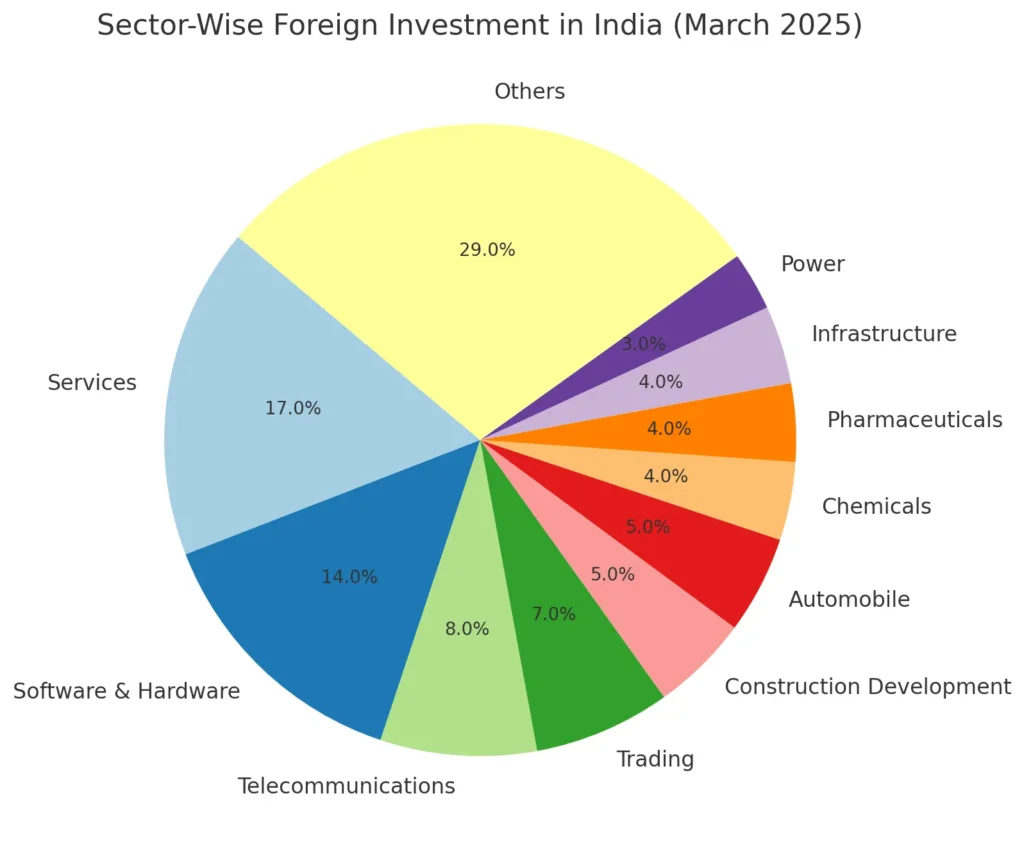

The pie chart illustrates how foreign investments are distributed across various sectors. As the chart shows, services (17%) and software & hardware (14%) continue to attract the highest share of foreign investments, followed by telecommunications (8%) and trading (7%). The finance and healthcare sectors also hold significant portions, reinforcing the expectation that these industries will see the most benefits from the new foreign investment cap. Thus, reinforcing the RBI’s argument that increasing the foreign investment limit could strengthen industries already benefiting from overseas capital.

How Is This Being Managed?

The Securities and Exchange Board of India (SEBI) keeps an eye on foreign investment in Indian companies. The National Stock Exchange (NSE) also plays a role by updating investors about how much foreign investment is allowed in different companies.

Foreign investments in India follow strict rules under the Foreign Exchange Management Act (FEMA), which ensures that no company exceeds its foreign investment limit. If a company gets too much foreign money, the stock exchanges immediately stop further foreign investment to prevent any disruptions.

What Are the Concerns?

While this move brings many benefits, SEBI has raised concerns about the risk of a takeover scenario. This means that, if a single foreign investor and their associates own more than 34% of a company, they could influence key business decisions of these Indian companies, potentially in ways that may not be beneficial to the country itself.

To prevent such situations, SEBI is considering stricter rules, such as requiring investors to report their partnerships and closely monitoring how foreign investments are made. Companies may also need to get approval before foreign investors increase their stakes beyond a certain point.

What Could Happen Next?

In the short term, more foreign investment could bring in billions of dollars, making the Indian stock market more stable and increasing the availability of funds for businesses. Over time, it could also help India strengthen its global economic ties and attract more international business.

Sectors that already receive high foreign investments—such as IT (which gets about 45% of total foreign investments), financial services (23%), and healthcare (12%)—are expected to benefit the most. If this policy works as planned, experts predict that an additional 25-30 billion USD could flow into the Indian stock market over the next two years.

This could also have other positive effects, such as strengthening the Indian rupee, increasing the country’s foreign currency reserves (currently at 615 billion USD), and reducing the need for India to borrow money from international sources.

Data Source: RBI Annual Report 2024-25.

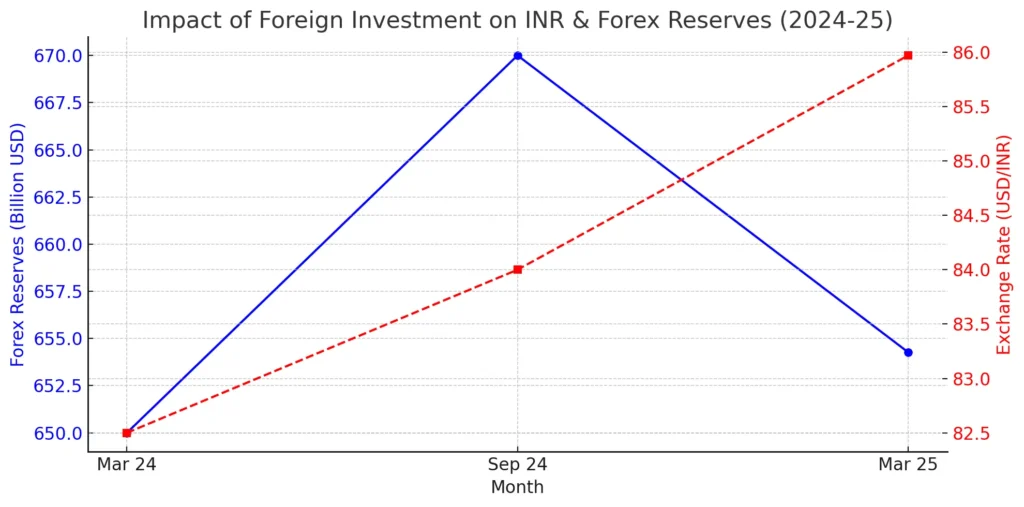

This dual-trend chart illustrates how India’s forex reserves and the INR exchange rate have been moving over time. As seen in the graph, forex reserves peaked at 670 billion USD in September 2024 before dropping to 654.27 billion USD by March 2025, reflecting capital outflows during that period. Simultaneously, the INR depreciated from 82.5 to 85.97 against the USD, emphasizing the impact of foreign investor activity on currency stability. So in other words, increased foreign investment could indeed help stabilize the rupee and build up forex reserves, reducing India’s reliance on external debt.

Final Thoughts

By allowing more foreign investment, India is making its stock market more attractive to global investors. While there are some concerns about foreign control, the authorities are working on solutions to manage them. If implemented well, this policy could bring long-term benefits to the Indian economy, making it stronger and more competitive on the world stage.