Commodity Prices: Why Should You Care?

Commodity prices—whether it’s oil, rice, gold, or copper—don’t just grab headlines on business news channels; they quietly shape your daily expenses, investment decisions, and even the economy at large. From cheaper fuel to expensive smartphones, these price swings ripple through every corner of our lives. But what do these changes actually mean for you? And how do economists interpret these market movements? Let’s break it down.

🚗 An Intuitive Perspective: How Does It Affect Me?

For most people, the key question is simple—how do commodity price changes impact daily life? Let’s start with something you notice every day: fuel prices. In early 2025, oil prices dropped by nearly 12%, primarily due to oversupply in the market and slowing demand from large economies like China and Europe. This has a direct benefit to consumers—cheaper fuel at petrol pumps, reduced transportation costs, and in the long run, even lower product prices as shipping expenses come down. It’s a chain reaction where falling fuel costs ease the burden on your monthly budget.

The food market also saw movement. Over the past year, India had restricted rice exports, leading to a rise in global rice prices. However, in February 2025, India relaxed those restrictions, resulting in an 8% fall in rice prices. This was good news for global consumers, making essential food items more affordable. Yet, it’s not without consequences—Indian farmers may now face income losses due to falling prices. Meanwhile, corn prices continue to fluctuate, driven by unpredictable weather patterns and global geopolitical tensions, leaving both consumers and producers uncertain.

Investors have also been keeping an eye on precious and industrial metals. Gold prices reached a new peak of $2,250 per ounce in March 2025, largely because of ongoing global uncertainties. Copper prices followed suit, climbing to a 15-month high, propelled by rising demand in the electric vehicle market, renewable energy sector, and electronics production. For an average person, this may seem like an opportunity to invest, but higher copper prices also mean costlier gadgets, electric vehicles, and home appliances.

📉 What About Inflation?

The good news for consumers is that global inflation has cooled down compared to its peak levels during 2022-23. Falling energy prices and stable food prices have played a crucial role in easing inflationary pressure. This shift could soon lead to lower interest rates, cheaper home and personal loans, and a general reduction in the cost of living. For households, this means some financial breathing room after years of persistent price rises.

📊 An Economist’s Perspective: What’s Really Happening?

While consumers experience these price changes in their daily expenses, economists see a bigger picture of structural forces at play. In the oil market, the current price drop is a classic case of supply-demand mismatch. There’s too much oil being produced, while global demand isn’t rising fast enough. This dynamic results in lower revenues for oil-exporting countries and puts deflationary pressure on the global economy, which may encourage central banks to cut interest rates to stimulate growth.

In the case of copper, the recent price surge isn’t solely due to booming demand. Supply constraints from mining disruptions in Latin America and speculative market behavior—especially ahead of anticipated U.S. tariffs on Chinese electric vehicle components—are also contributing factors. This can have wide-reaching impacts on the manufacturing costs of automobiles, semiconductors, and renewable energy infrastructure.

Food prices, too, remain highly sensitive to government policies. India’s decision to ease rice export restrictions is a clear example of how much influence trade policy can have on global food markets. These price movements often trigger broader conversations about trade regulations, food security, and protectionist policies.

🌍 The Bigger Picture: Dollar Strength & Emerging Markets

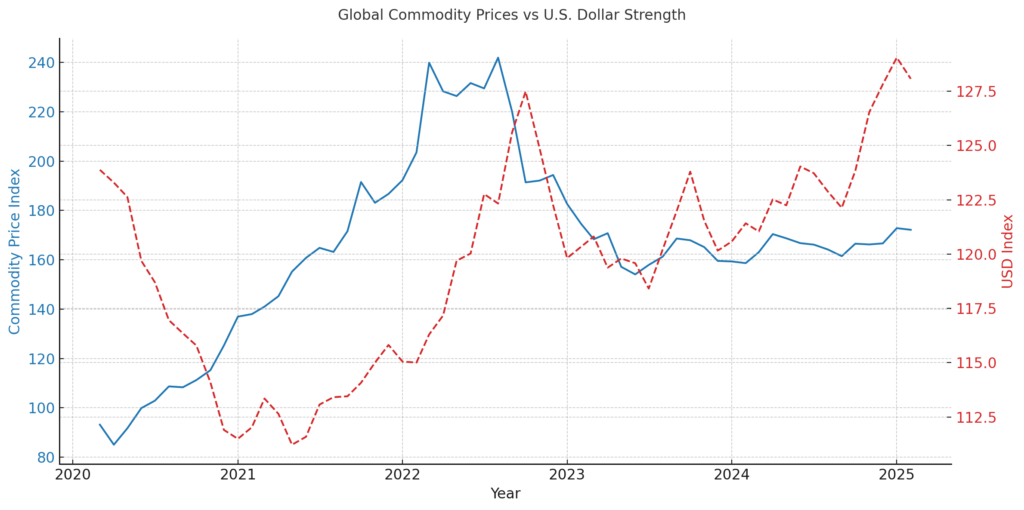

The volatility in commodity prices has also contributed to the strengthening of the U.S. dollar, making it more expensive for emerging economies to import essential goods. Additionally, China’s sluggish demand for commodities remains a crucial factor in the global market. Any increase in Chinese consumption could quickly ripple across markets worldwide, influencing commodity prices, inflation, and global trade dynamics.

Source: USD(FRED); Commodity(FRED)

The relationship between commodity prices and the U.S. dollar plays a crucial role in shaping global economic trends and personal financial decisions. As discussed in the article, recent fluctuations in oil, gold, and copper prices have been driven by a mix of supply-demand dynamics, geopolitical factors, and investor sentiment. However, one of the biggest underlying forces influencing these price swings is the strength of the U.S. dollar.

Historically, commodity prices and the U.S. dollar move in opposite directions. When the dollar strengthens, commodities like oil, gold, and metals become more expensive for foreign buyers, leading to lower demand and price declines. This pattern is evident in early 2025’s drop in oil prices, which coincided with a stronger dollar, reducing energy costs for consumers and easing inflationary pressures. On the other hand, as gold and copper prices surged, part of this movement was influenced by the dollar’s fluctuations, with investors seeking safe-haven assets amid economic uncertainty.

For emerging markets, a stronger dollar means higher costs for importing essential goods, which can strain their economies. At the same time, commodity-exporting nations may struggle with declining revenues when prices fall. This explains why shifts in China’s commodity demand—as highlighted in the article—are closely watched, as any increase in Chinese consumption can quickly reverse trends in global markets, influencing inflation and trade balances worldwide.

Ultimately, the interplay between the U.S. dollar and commodity prices is more than just a financial statistic—it shapes the cost of fuel, food, and goods that impact everyday life. Whether it’s cheaper gasoline, fluctuating grocery bills, or rising electronics costs, these price movements reflect deeper macroeconomic forces at work. Understanding this relationship helps connect the dots between market headlines and real-world financial decisions, making it clear why commodity prices truly matter.

✅ The Bottom Line: Why It Matters to You

For the average consumer, falling fuel prices translate to more money saved at the gas station, while shifts in food prices directly impact grocery bills. Soaring gold and copper prices may offer investment opportunities but also signal higher costs for electronics and automobiles. For economists and policymakers, these price movements are not isolated events; they reflect deeper structural shifts involving supply-demand imbalances, government interventions, and broader macroeconomic trends that will shape the global economy in 2025 and beyond. The next time you notice cheaper fuel or pricier smartphones, remember—it’s not just market noise. It’s a reflection of powerful global forces quietly shaping your world.

🔍 References

1. Marketwatch

2. Reuters

3. FinancialTimes

4. The Guardian