RBI’s Recent Actions Against Banks and NBFCs: A Detailed Analysis

The Reserve Bank of India (RBI), the country’s apex financial regulatory body, has recently undertaken stringent actions against certain banks and Non-Banking Financial Companies (NBFCs). These measures highlight the central bank’s commitment to maintaining financial stability, safeguarding depositors’ interests, and ensuring that financial institutions operate within regulatory frameworks. This article delves into the specifics of the RBI’s actions, the reasons behind them, and their potential implications, particularly in the context of India’s bad loan (NPA) crisis.

RBI’s Restrictions on New India Co-operative Bank

One of the most significant developments has been the RBI’s restrictions on Mumbai-based New India Co-operative Bank. Effective from February 13, 2025, the bank has been barred from granting fresh loans, accepting new deposits, and allowing withdrawals due to concerns over its deteriorating financial health.

Reasons Behind RBI’s Restrictions

The restrictions stem from the bank’s consistent financial losses over the past few years. In the financial year ending March 2024, the bank reported a loss of ₹22.78 crore, following an even greater loss of ₹30.75 crore the previous year. These persistent losses raised concerns about its liquidity and capital adequacy, prompting the RBI to intervene.

A key factor behind these losses could be the accumulation of bad loans (Non-Performing Assets – NPAs). If the bank has a high percentage of loans that borrowers are unable to repay, it impacts its financial health, leading to liquidity issues and regulatory action. This reflects a broader issue within India’s banking system, where smaller banks and cooperative institutions often struggle with loan recovery.

Impact on Customers

The RBI’s action has caused significant distress among the bank’s depositors. Many customers have expressed concerns about accessing their funds, leading to a surge in panic outside the bank’s branches. However, the RBI has assured depositors that insurance coverage of up to ₹5 lakh per depositor is available under the Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme. This means that those holding deposits within this limit will be able to claim their money after due verification.

RBI’s Crackdown on NBFCs

In addition to its action against New India Co-operative Bank, the RBI has also taken stringent steps against four prominent NBFCs:

- Asirvad Micro Finance

- Arohan Financial Services

- DMI Finance

- Navi Finserv

Why Were These NBFCs Banned from Issuing Loans?

In October 2024, the RBI imposed a ban on these NBFCs from issuing fresh loans due to their engagement in outrageous pricing practices. According to reports, these companies were charging excessively high interest rates, with significant mark-ups over their actual cost of funding. This practice violated Fair Lending Practices and posed risks to borrowers.

This action is significant in the context of India’s bad loan crisis. If NBFCs engage in aggressive and predatory lending, many borrowers may struggle to repay their loans, leading to an increase in NPAs. By banning these companies from issuing new loans, the RBI is taking a preventive approach to avoid a potential NPA surge in the NBFC sector.

Consequences for the NBFC Sector

This move has sent a strong message to the NBFC industry about the importance of ethical lending. It underscores the RBI’s stance against predatory lending practices, ensuring that financial companies do not exploit consumers with unfair loan terms. Additionally, by enforcing these measures, the RBI is indirectly preventing the accumulation of bad loans in the sector, reinforcing its long-term strategy to maintain financial stability.

Connection to India’s NPA Problem

The RBI’s actions align with ongoing efforts to tackle India’s bad loan crisis. Over the years, India’s banking system has struggled with high levels of NPAs, especially in public sector banks and cooperative banks. While large commercial banks have made progress in reducing NPAs, smaller cooperative banks and NBFCs remain vulnerable due to weaker governance structures and high-risk lending.

According to our previous insights as well, India’s bad loan problem has improved, but the financial sector still requires strict oversight to prevent future crises. The RBI’s interventions in both New India Co-operative Bank and NBFCs show a proactive stance to prevent NPAs from accumulating, which could destabilize the financial system if left unchecked.

The following visualizations provide key insights into India’s banking sector trends from 2019 to 2024. They highlight improvements in asset quality, financial expansion, and the growing issue of unclaimed deposits. These trends reflect the impact of regulatory measures, economic shifts, and changing banking practices.

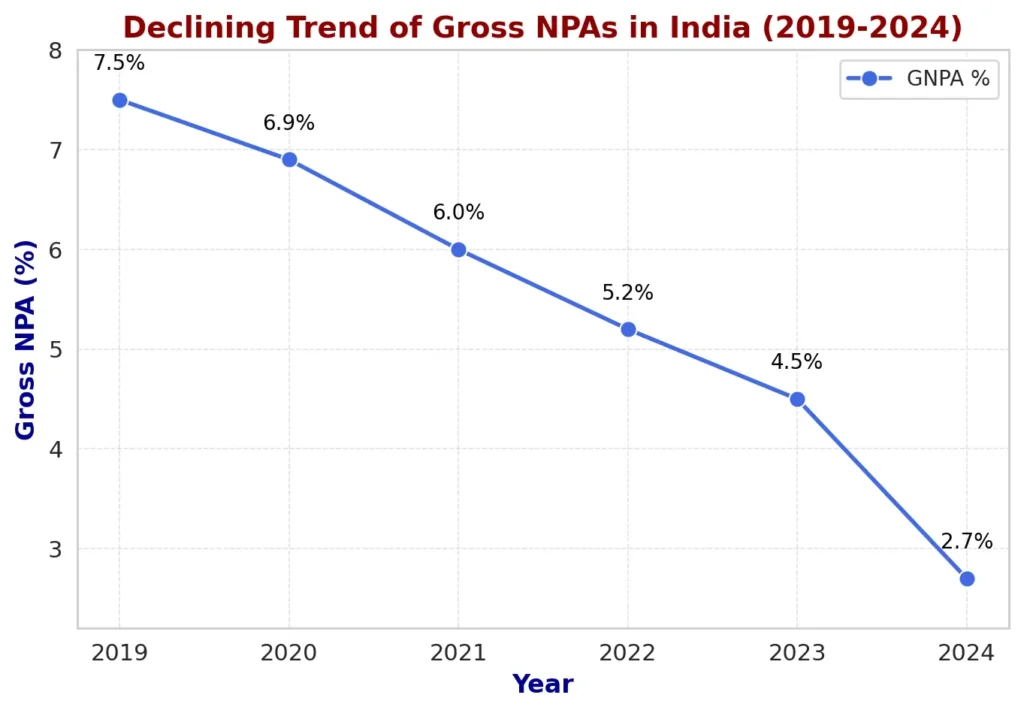

Graph 1; Data Source: Dataful

📊 Graph 1 Explanation:

- This visualization showcases the declining Gross NPA percentages in India from 2019 to 2024.

- The trend reflects a positive shift in financial stability, largely driven by RBI regulations, better risk management, and strengthened banking policies.

- The steady reduction indicates banks are improving asset quality, with fewer loans turning bad, supporting RBI’s broader financial reforms.

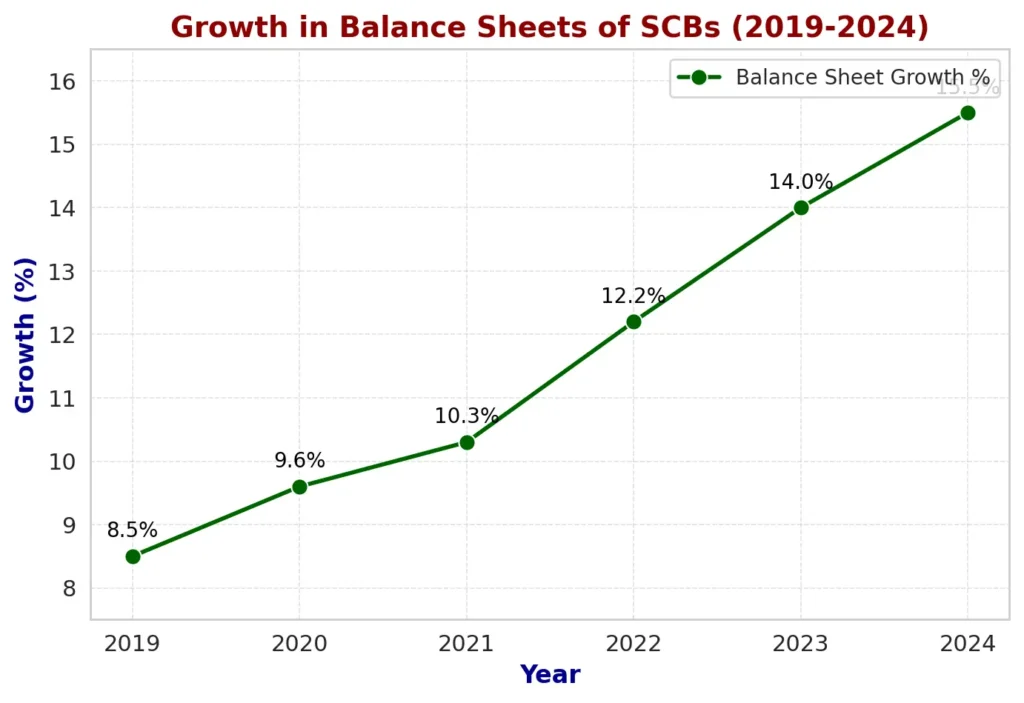

Graph 2; Data Source: DataFul

📊 Graph 2 Explanation:

- This trend line shows the year-on-year growth in the balance sheets of Scheduled Commercial Banks (SCBs) from 2019 to 2024, reflecting an increase in financial assets, lending, and overall banking activity.

- The steady rise from 8.5% in 2019 to 15.5% in 2024 indicates strong financial expansion, likely driven by economic growth, credit demand, and improved banking sector resilience.

- This visualization helps contextualize RBI’s interventions—while certain institutions face restrictions due to risky lending practices, the broader banking sector continues to expand.

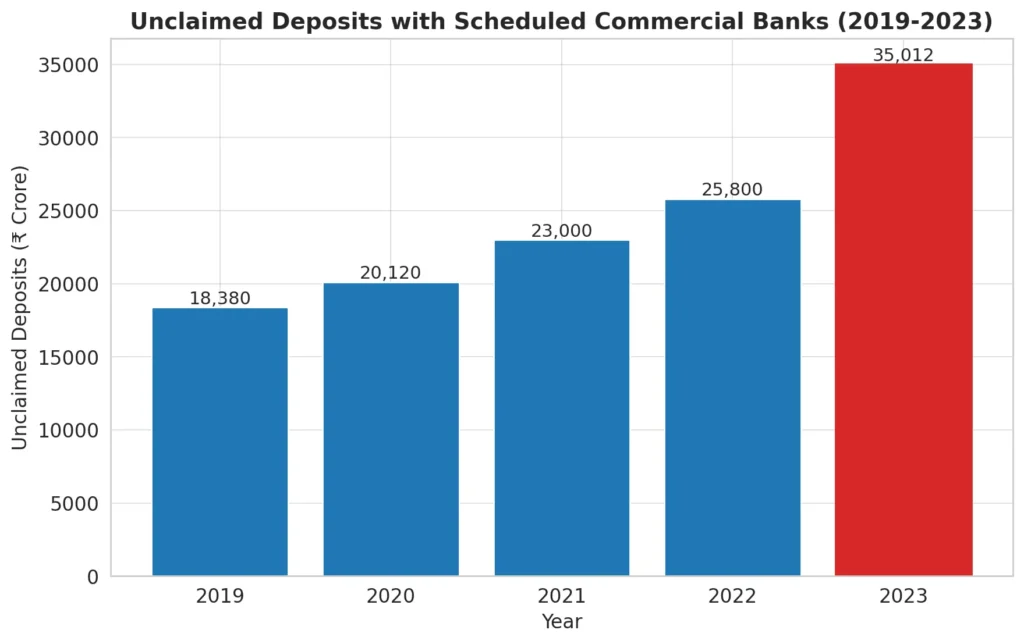

Graph 3 Data Source: DataFul

📊 Graph Explanation:

The above bar chart illustrates the increasing trend of unclaimed deposits with Scheduled Commercial Banks from 2019 to 2023. Over this period, the total amount of unclaimed deposits has grown significantly, reaching ₹35,012 crore in 2023. The last bar is highlighted in red to emphasize the sharp increase in unclaimed deposits in the most recent year. This trend highlights the need for greater financial awareness among account holders and stricter regulatory efforts to address inactive or forgotten accounts.

Together, these graphs depict a dynamic financial landscape in India. While the decline in NPAs and balance sheet growth signal a healthier banking sector, the rise in unclaimed deposits underscores the need for increased financial awareness and regulatory oversight. Understanding these trends is crucial for policymakers, financial institutions, and account holders alike.

Potential Implications of These Actions

- Increased Scrutiny of Financial Institutions: RBI’s strict oversight will likely lead to increased compliance requirements for banks and NBFCs, ensuring they maintain financial stability and transparency.

- Enhanced Consumer Protection: The actions against unfair lending practices demonstrate the RBI’s commitment to protecting consumers from exploitative financial products.

- Market Confidence: While these actions may create short-term distress, they reinforce trust in India’s banking system by ensuring only stable and well-managed institutions operate in the financial space.

- Reduction in Future NPAs: By restricting high-risk lending and ensuring financial discipline, the RBI is taking steps to prevent another surge in bad loans, which has been a recurring issue in India’s banking history.

- Potential for Mergers and Acquisitions: Struggling cooperative banks may be encouraged to merge with stronger banks to improve financial health and prevent disruptions to depositors.

Conclusion

The RBI’s recent actions against New India Co-operative Bank and select NBFCs emphasize the regulator’s firm approach to financial discipline. By enforcing strict lending norms and ensuring depositor protection, the RBI aims to build a more resilient financial ecosystem. These actions also tie into India’s broader strategy to reduce NPAs and prevent financial instability caused by risky lending practices.

For depositors and borrowers, these developments serve as a reminder to stay informed about the financial health of institutions they engage with. As regulatory scrutiny tightens, the onus is on financial entities to operate with transparency and efficiency to maintain their credibility in the market. Ultimately, these steps will contribute to a healthier and more stable banking sector in India.

Good going.

Keep sharing more